47+ how much of gross income should go to mortgage

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Find A Lender That Offers Great Service.

Budget 2020 Old Vs New Income Tax Regime Which Is Better

Web What percentage of income do I need for a mortgage.

. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers. Estimate your monthly mortgage payment.

Comparisons Trusted by 55000000. So for example if your monthly income. Ad Check How Much Home Loan You Can Afford.

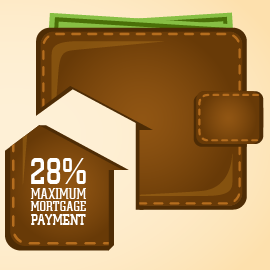

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Thats a mortgage between 120000 and.

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Apply Online To Enjoy A Service. Comparisons Trusted by 55000000.

Ad 10 Best House Loan Lenders Compared Reviewed. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Get Instantly Matched With Your Ideal Mortgage Lender.

Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Ad Compare More Than Just Rates. So if your gross.

Ad Calculate Your Payment with 0 Down. A front-end and back-end ratio. Web Most lenders look for a maximum DTI of 40 on applications for most sorts of mortgages.

John in the above example makes. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Compare Loans Calculate Payments - All Online.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Lock Your Rate Today. Ad Highest Satisfaction for Mortgage Origination.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

And you should make. But thats a very general guideline. However how much you.

Web Finally the 25 post-tax model says that your total monthly debt should be 25 or less of your monthly post-tax income. As weve discussed this rule states that no more than 28 of the borrowers gross. Ad See how much house you can afford.

Thats a mortgage between 120000 and. This rule says that you should not spend more than 28 of. Ad 10 Best House Loan Lenders Compared Reviewed.

Some applicants get approved with DTIs or 45. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income. Keep your total debt payments at or below 40 of your pretax monthly income. Lock Your Rate Today.

Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage. 50 of net pay for needs 30 for wants and 20 for savings and debt. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

Web The 2836 is based on two calculations. Get Instantly Matched With Your Ideal Mortgage Lender. Web Our 503020 calculator divides your take-home income into suggested spending in three categories.

Ad Calculate Your Payment with 0 Down. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

5 Things You Did Not Know About Personal Loan Axis Bank

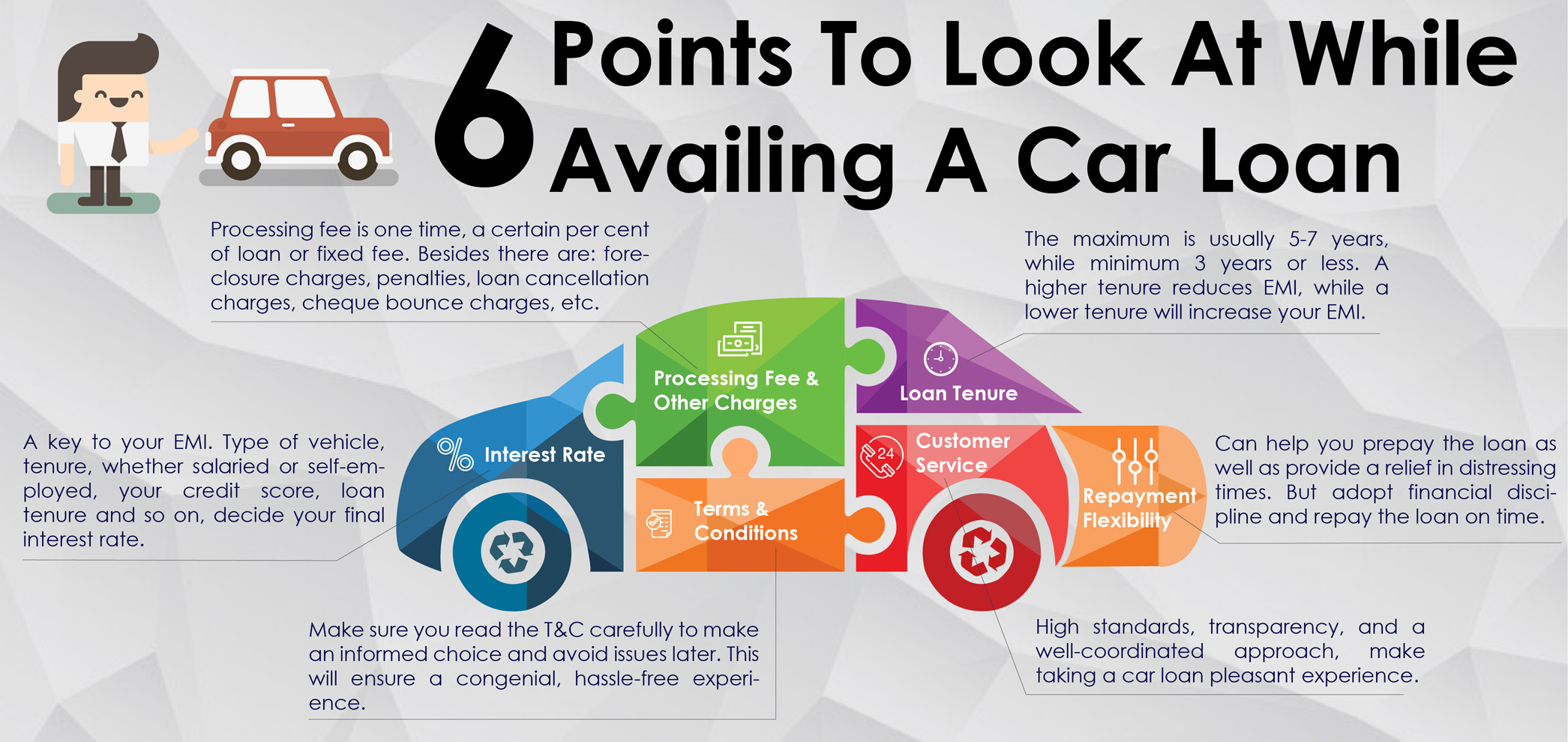

6 Points To Look At While Buying A Car For Your Family This Festive Season Axis Bank

What Percentage Of Your Income Should Go To Mortgage Chase

Four Types Of Loans That Help You Avail Tax Benefits Axis Bank

What Percentage Of Income Should Go To Mortgage

Financial Literacy Guide To Personal Finances

Income To Mortgage Ratio What Should Yours Be Moneyunder30

When Should You Get An Emergency Loan Axis Bank

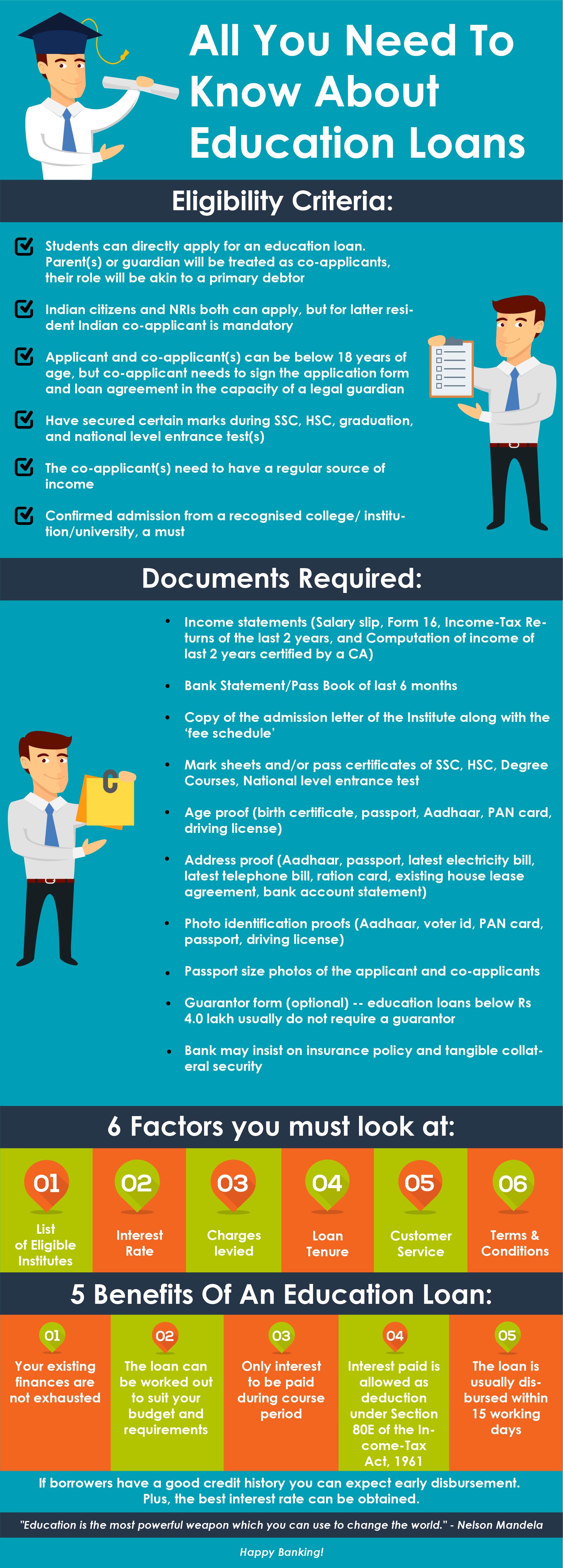

How An Education Loan Can Empower You

-(1).jpg)

Top 5 Car Loan Tips For Youngsters Axis Bank

What Percentage Of Income Should Go To Mortgage

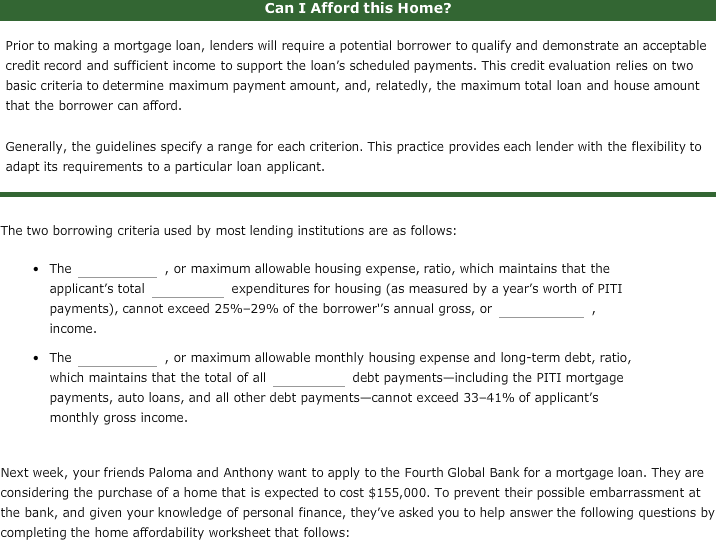

Solved First Filling The Blank A Back End B Front End Chegg Com

Need A Mortgage Keep Debt Levels In Check The New York Times

5 Factors That Affect Your Personal Loan Interest Rate Axis Bank

How Much House Can I Afford Insider Tips And Home Affordability Calculator

Percentage Of Income For Mortgage Payments Quicken Loans

What Percentage Of Income Should Go To My Mortgage Mares Mortgage